USDC stablecoin is depegging – and at an alarming price – falling to as little as $0.89, method off its $1 peg.

Volatility is predicted to proceed all over the weekend as panic units in after the Silicon Valley Financial institution cave in.

The failure of SVB is hurting the reserve place of USDC, which is issued by way of Circle.

Individuals of the consortium in the back of the USDC stablecoin come with Coinbase, the biggest trade in the United States. Coinbase may see its percentage worth come below force when markets open on Monday.

In a tweet final evening, Circle let it’s identified that USDC has 1 / 4 of its reserves in money held at 7 banking companions, together with Silvergate and SVB. USDC has $3.3 billion tied up at SVB.

The rest of USDC’s reserves are in short-dated US Treasuries cash marketplace finances held at BNY Mellon Financial institution.

Sadly for plenty of USDC depositors – which might be most commonly tech startups and VCs – the majority of their finances aren’t insured by way of the Federal Deposit Insurance coverage Affiliation (FDIC), because the ensure handiest covers the primary $250,000.

The California Division of Monetary Coverage and Innovation took regulate of SVB – and made the FDIC the receiver – after depositors initiated a run at the financial institution by way of seeking to withdraw up to $45 billion on Thursday.

USDC is the second-largest stablecoin within the crypto ecosystem and is an crucial a part of the business’s plumbing.

Contents

- 1 How SVB was once laid low – which banks may well be subsequent?

- 2 Banking machine frailties make the case for bitcoin as a shop of price

- 3 USDC and DAI in bother – which of the highest stablecoins are in danger?

- 4 Ethereum fuel charges spike

- 5 Yikes! One dealer paid $2m to obtain $0.05 USDT

- 6 Purchase USDC nowadays and you need to make some huge cash – you need to additionally lose all of it

- 7 Who Will purchase SVB? Elon Musk?

How SVB was once laid low – which banks may well be subsequent?

The difficulty started for SVB when it was once pressured to promote its long-dated US Treasuries at a loss.

SVB have been the use of buyer deposits to shop for long-dated US executive bonds that it supposed to carry to adulthood for a small but dependable go back. That is not unusual apply within the fractional banking style that underpins trendy banking.

However so as to meet deposit withdrawal calls for, SVB needed to promote the ones bonds at a loss. The Fed hanging up rates of interest way the worth of bonds falls, as a result of bond yields and worth have an inverse dating.

That supposed SVB’s belongings have been value lower than it purchased them for. It ended up incurring a lack of $1.8 billion.

Once more, in commonplace instances those would now not be an issue because the bonds could be held to adulthood, but when pressured gross sales happen then the ones unrealized losses grow to be discovered.

To hide the ones loses, and long term anticipated loses, SVB determined to factor fairness.

That is when the alarm bells began ringing amongst its depositor base.

SVB has $175.4 billion general deposits of which $151 billion are uninsured, accounting for 85% of its deposits.

Peter Thiel’s Founders Fund urged depositors to get out, which was once the nail within the coffin for SVB – financial institution runs are onerous to prevent.

Banking machine frailties make the case for bitcoin as a shop of price

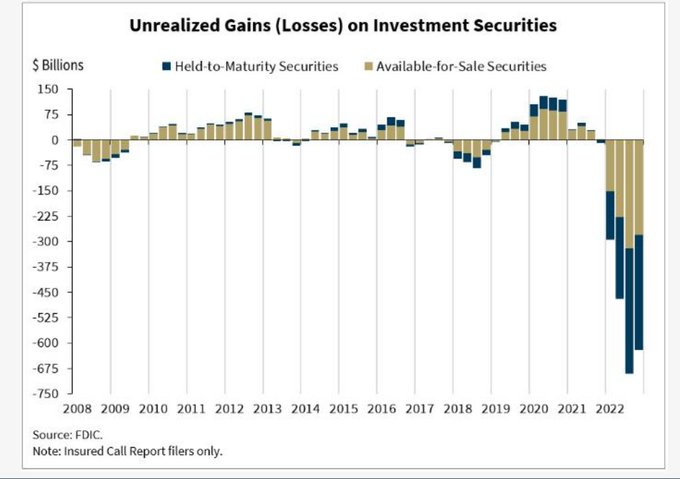

Worryingly for the banking machine, SVB isn’t on my own in having those types of unrealized losses on its stability sheet, because the chart from the FDIC displays underneath:

Different banks may now grow to be a goal for brief dealers and their depositors may begin to grow to be frightened.

California-based First Republic Financial institution, which caters to a rich shopper base, noticed its stocks fall up to 15% on Friday. Different regional banks have come below force too.

The banking machine’s frailties won’t prolong to the well-capitalized large banks, however the regulator could have taken its eye off the ball so far as the smaller establishments are involved, as noticed with Silvergate and SVB.

Despite the fact that it can be onerous to realize this at this time, however the unfolding drama does if truth be told spotlight the forged use case of bitcoin as a shop of price.

Perhaps that is why the cost of bitcoin hasn’t cratered on information of the Silicon Valley Financial institution failure, even though that may be for the reason that Silvergate information earlier than it was once sufficient to get the dealers out.

Nonetheless, the bitcoin worth previously 24 hours and has held up properly, yet marketplace individuals can be expecting extra volatility forward.

Bitcoin has rallied 64% from its near-term backside and has handiest pulled again 20% up to now.

At this level investors may well be forgiven for considering bitcoin is a stabler coin than USDC.

Additionally, bitcoin holders will probably be comforted by way of the truth that it has an enormous area of strengthen on the quantity profile line of regulate (pink line) across the $16,000 ranges.

USDC and DAI in bother – which of the highest stablecoins are in danger?

Buyers and crypto corporations reacted to the inside track of USDC reserve publicity to SVB by way of exiting their positions within the stablecoin and shifting into Tether (USDT).

USDT is the unique stablecoin yet hasn’t ever performed a complete audit of its reserves, however is now noticed as more secure than USDC.

As a ensuing of the purchasing force, Tether has now moved off its peg in a favorable path, valued at $1.01.

Different stablecoin issuers have rushed to place out statements declaring they’ve no SVB publicity, together with Gemini which problems Paxos, Binance, the issuer of BUSD.

Tether CTO Paolo Ardoino printed a observation announcing that USDT has no SVB publicity.

The implosion of USDC is having a long way flung affects within the crypto house that would flip the crypto wintry weather into an Ice Age disaster.

Decentralized trade Curve has noticed its 3Pool stablecoin pool pass wildly out of stability. DAI, USDC and USDT are held in more or less equivalent in proportions – yet that is in commonplace instances.

Now handiest about 6% is in USDT whilst USDC and DAI every make up greater than 40% of the pool.

DAI is closely collateralized by way of USDC and could also be being depegged as of now – these days converting palms for $0.90 as an alternative of $1. DAI is the fourth-largest stablecoin.

Ethereum fuel charges spike

Some other direct result of the most recent twist within the crypto disaster is Ethereum fuel charges surging to 300+ Gwei.

That equates to transaction prices at the Ethereum blockchain that at one degree have been forcing Uniswap customers to pay on reasonable $90 to transport finances.

On the time of writing reasonable Gwei is 83 yet may spike once more as the United States Saturday consultation opens.

The Ethereum chain is changing into congested as more than a few crypto corporations try to reposition their finances to offer protection to themselves from SVB contagion.

Yikes! One dealer paid $2m to obtain $0.05 USDT

Such is the extent of dysfunction available on the market, one dealer who was once staking in a liquidity pool attempted to get out yet didn’t set his slippage – very similar to surroundings a prohibit order in equities.

Consequently the dealer fell sufferer to a so-called maximal extractable price bot. The transaction ended up costing $2,080,468.85 to obtain $0.05 of USDT:

Purchase USDC nowadays and you need to make some huge cash – you need to additionally lose all of it

For many who aren’t petrified of high-octane chance there may well be large quantities of cash to be made.

Arbitrageurs may purchase USDC in its depegged state after which redeem it for $1 on Monday, pocketing the adaptation.

However in fact this is extremely dangerous as a result of nobody is aware of what the FDIC will do concerning the uninsured deposits at SVB, of which the USDC reserves to pay redemptions are an element.

Some will argue that the taxpayer shouldn’t have any industry with bailing out a financial institution that went all in on construction a deposit base that lacked variety, because of its preponderance of tech startup and VC deposits.

Michael Egorov, founding father of Curve Finance, in feedback to Bloomberg mentioned the whole thing will end up ok, yet he would say that would not he?

“I believe that we will be able to see a large number of volatility in USDC worth over the weekend as a result of USDC redemptions gained’t paintings in that point – banks don’t paintings on weekends,”

He then expectantly added: “Alternatively, the placement may grow to be higher as soon as redemption get started operating on Monday, and a few investors will purchase reasonable USDC and redeem 1:1 to USD.”

Who Will purchase SVB? Elon Musk?

On Monday marketplace individuals will probably be having a look to peer how the FDIC intends to deal with the problem of the uninsured deposits. Ket to that will probably be if a purchaser of the financial institution can also be discovered.

Alternatively, would possibly large banks will probably be cautious of having entangled with SVB at a time of significant uncertainty.

Elon Musk, playfully most likely, hinted that he may well be fascinated with purchasing the financial institution.

However Musk has shape on now not following via on his tweeted statements.

Supply By way of https://cryptonews.com/information/how-usdc-stablecoin-depegging-could-break-many-crypto-firms-but-bitcoin-will-stronger.htm